HP 50g Calculator - Time Value of Money (TVM) CalculationIntroduction to financial terminology used in solving financial problemsMany financial problems are based on the concept of charging a fee (interest) for the use of someone else's money over a fixed period of time. The phrase, time value of money (TVM) describes these types of financial calculations. In TVM calculations, the most common problems use two types of interest:

With simple interest, only the principal (the original amount of money) earns interest for the entire duration of the transaction. The principal, plus interest earned, is repaid in one lump sum. When simple interest is added to the principal at specified compounding intervals, and thereafter, also earns interest, the interest is compounded. Savings accounts, mortgages and leases are examples of compounded interest calculations. TVM elementsThe standard variables used to describe most compound interest (TVM) problems:

The ‘Solve finance’ option of the Numerical

Solver (NUM.SLV) menu is used for these types of TVM calculations. To

access the 'TIME VALUE OF MONEY' input page, press

. This application can also be started by using the keystroke combination

. This application can also be started by using the keystroke combination

.

.To solve an unknown variable, use the arrow

cursor keys to move about the page and key in all known values in the

highlighted fields. Once all known variables have been assigned values,

highlight the field of the unknown value with the cursor keys, and press

the

key to calculate it.

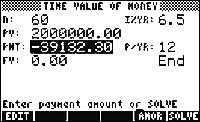

key to calculate it.TVM exampleCalculating the payment on a loan If $2 million is borrowed at an annual interest rate of 6.5% to be repaid in 60 monthly payments, what should be the monthly payment? For the debt to be totally repaid in 60 months, assume the future value of the loan will be zero, and payments will be made at the end of each compounding period. For this example, use the following values: n = 60, I%YR = 6.5, PV = 2000000, FV = 0, P/YR = 12. To enter the data and solve for the payment, PMT:

The solution screen appears as shown below: Figure 1: The solution screen

NOTE: The final solution is a negative

value. Although it may seem odd, the answer is correct, because the

calculator solves TVM problems based on cash flow diagrams. Cash flow

diagrams identify both positive and negative cash flows in financial

problems. In this case, the loan is considered a positive cash flow; it

is the money received. The payment is a negative cash flow, and, as

such, it has a negative value. It is the money payable.

|

Preparing for HP separationclose

This support site has been split:

|

You are on HP Support Center for products such as printers, tablets, and desktops. |

|

|

For products such as servers, storage, and networking, go to HP Support Center - Hewlett Packard Enterprise . |